Introduction to Elysium Research - Prop Risk Model & Trade Sizing

By Elsysium

Welcome to Elysium Research. I am a young investor (not trader) focusing primarily on equities. I started trading in the stock market when I was 14 years old as a pure hobby. Through the ups and downs of the market and constant learning, it became more than a hobby. Funny enough, my work experience is as a quantitative energy trader operating mainly in European power and gas. My strengths rely on fundamental analysis and spotting future trends that are potentially mispriced by market participants.

I wanted to use this substack to share my research thesis on mispriced stocks in which I am personally investing. The research pieces will be mostly free, but my proprietary risk model and trade sizing strategy as well as some “top” investment picks will be available only to paying subscribers.

Now I briefly introduced myself & this substack, I wanted to go over the 2 most important factors in investing (in my opinion) which are risk management & trade sizing. It really doesn’t matter how good your research thesis is (believe me I learned the hard way) if you do not follow a risk model and an appropriate trade sizing. Understanding price action is equally important, price action hints to us if our thesis might be correct or not. While markets can remain disconnected from fundamentals it’s not our battle to stick to a losing trade. It is inherently human to try and catch the “bottom” but in investing it is simply a losing strategy and mindset.

That is why I spend a lot of time developing a risk model that would work for my investing strategy. While it is not a perfect model (they don’t exist) it has a great degree of accuracy at determining changes in trend, as ultimately stocks move on trends. I wanted a risk model that would predict trend changes but if wrong by the price action have a minimal loss. This would allow me to have a plan and a reference to trade sizing (point 2) for my investment research picks and not suffer big losses when the market goes against my thesis.

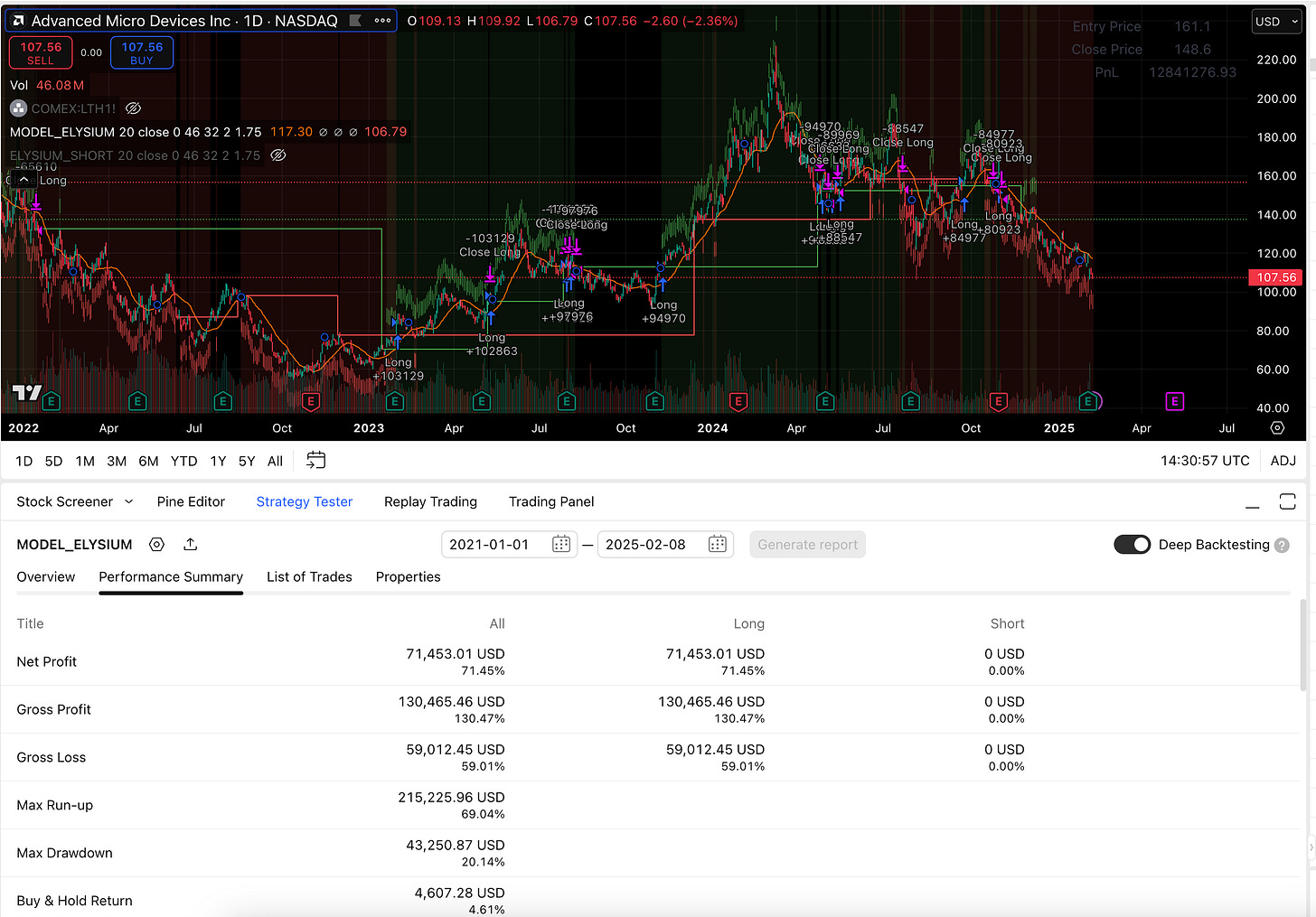

For instance, pick AMD. Since 2021, AMD has only gained 5% of its value, but following every trade of my risk model would have caused you to make a 71% net return (note: it does not short).

It is also important to note that this risk model is not perfect. It is designed to best predict changes in trend and will never outperform a buy-and-hold strategy of stock at all-time highs (I needed to clarify that). That is not its purpose. My proprietary risk model and other experimental quant strategies will be available to subscribers in full detail.

Moving on to my trade sizing rules:

#1. Start with 10-15% of the full size for that position. Full size for an investment is usually 10% of my portfolio. So start with 10% of 10% so that you are in the trade, then have a mental 5-7% stop loss. If the trade goes your way then I would wait for my risk model buy alert and would size full slowly in the next trading weeks.

#2. Do not try to catch falling knives. I know this has little to do with trade sizing but it is equally important to understand that falling knives o

ccur when large number of shares are being sold without much buying demand. Usually, that kind of selling pressure persists in the short term leading to lower prices even more.

#3. Price Action matters. While everyone tends to think they are smart or their research is accurate, markets tend to at some point adjust and reflect the fundamentals of a company. Therefore, do not end up holding a bag despite a good investment thesis, you can always re-enter a stock.